Behavioral, Goals-based ETF model Portfolios

Our behavioral goals-based ETF model portfolios prioritize achieving specific investor objectives over merely maximizing returns or minimizing risk. With this approach, we view our client’s investment risk as failure to meet their goals, rather than the volatility of returns.

By focusing on what truly matters to our clients—whether it’s funding education or retirement—we can better align investment strategies with individual aspirations. Understanding a client’s goals and tolerance for risk enables us to guide them towards smarter, more meaningful investment choices, ultimately leading to greater satisfaction and success in reaching their financial milestones.

ETFs offer our clients the ease of stock trading, low-cost, tax-efficiency, and the diversification benefits of mutual funds.

CRG’s multi-manager ETF model portfolios:

- Combine both index and actively managed ETFs.

- Are constructed using ETF funds from a curated list of reputable asset managers – [including BlackRock, Vanguard, Invesco, JP Morgan, and PIMCO].

Our main objective is to provide our clients with low cost, tax efficient, and broadly diversified 3–dimensional market exposure to EQUITY, FIXED-INCOME, and ALTERNATIVE markets, to help them achieve their life goals.

INVESTMENT STRATEGY

- Diversification: Combining ETFs from multiple asset managers and across asset classes reduces concentration risk and smooths returns.

- Core-Satellite Approach: Index ETFs often serve as the “core” holdings providing broad market exposure at low cost, while actively managed ETFs act as “satellites” aiming to add incremental returns or manage risk.

- Risk Management: Portfolios are designed with risk controls aligned to the client’s risk profile, including diversification and fixed income allocations to dampen volatility.

- Cost Efficiency: Using ETFs generally keeps costs lower than mutual funds or separate accounts, with an emphasis on low expense ratios, especially for passive ETFs.

- Dynamic Adjustments: Active ETFs allow for tactical positioning within asset classes, potentially improving performance during changing market conditions.

Our 3-Dimensional ETF Model Portfolios are built using a mix of equity, fixed income, and alternatives and offer 5 goals-based allocation buckets – Conservative, Moderate, Balanced, Growth, and Aggressive.

The series is designed cost-efficiently using ETFs to address our clients’ varied investment objectives, time horizon, and risk tolerances, while mitigating drawdown risk for each goals-based allocation bucket.

Multi-Manager Approach:

-

- CRG uses ETFs managed by well-known asset managers (BlackRock, Vanguard, JP Morgan, Invesco, PIMCO).

- This approach leverages the strengths and expertise of multiple managers, reducing manager-specific risk.

- The mix includes both index ETFs (passive) and actively managed ETFs to balance cost efficiency with the potential for alpha generation.

ETF Selection

ETFs are chosen from a select list based on the following criteria:

-

- Fund size and liquidity

- Expense ratios

- Tracking error (for index ETFs)

- Historical performance and manager reputation (for active ETFs)

- Fit within the overall portfolio allocation and diversification goals

Rebalancing Frequency:

- Quarterly or as needed

PERFORMANCE CONSIDERATIONS

- Balanced Risk and Return: Multi-manager ETF portfolios aim to provide a balance between growth and capital preservation tailored to investor risk tolerance.

- Benchmark Comparison: Performance is typically measured against relevant benchmarks (e.g., blended indices matching the portfolio’s asset allocation).

- Active vs Passive Impact: The inclusion of active ETFs can lead to outperformance or underperformance relative to purely passive portfolios, depending on manager skill and market environment.

- Costs: Expense ratios and trading costs impact net returns, but the multi-manager approach seeks to optimize net performance by selecting cost-effective ETFs.

- Historical Results: Actual performance depends on market conditions and the specific portfolio mix. Generally, diversified multi-manager ETF portfolios have shown to provide smoother returns with lower volatility compared to single-manager or single-asset class portfolios.

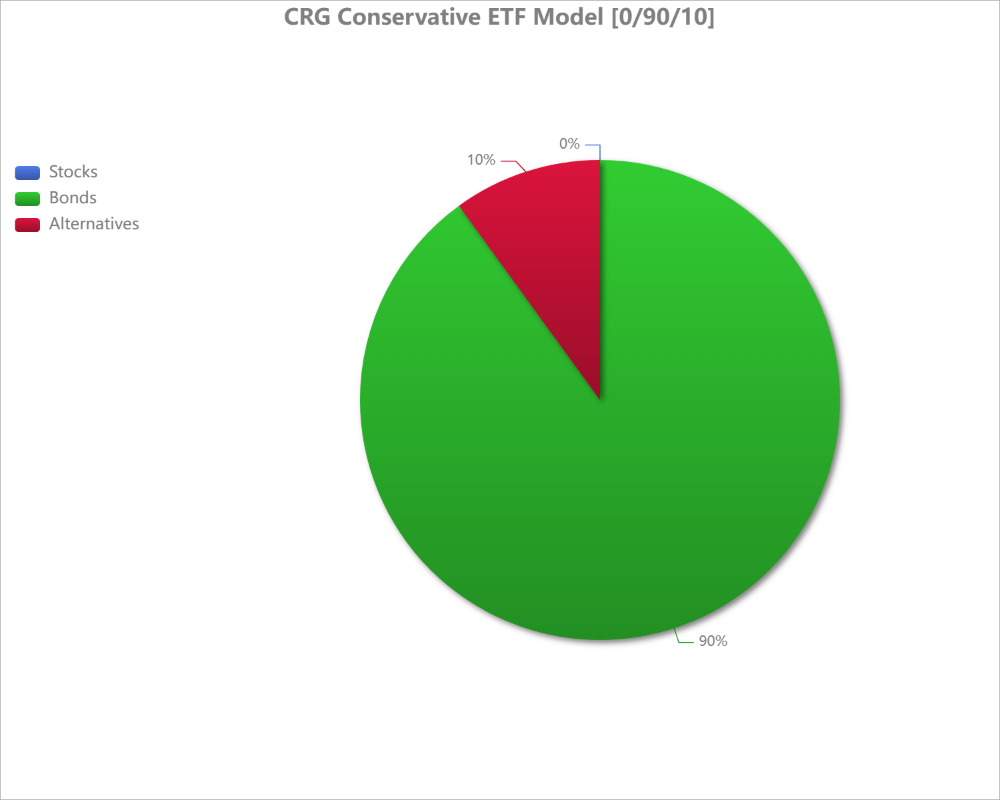

OBJECTIVE:

The Conservative ETF Model is designed for investors seeking steady, low-risk allocation with a primary focus on capital preservation and income generation. This model portfolio emphasizes stability by investing predominantly in high-quality, income-producing assets with limited exposure to market volatility.

| RISK LEVEL | Very Low |

| TIME HORIZON (YRS) | 0 – 3 |

| RISK SCORE RANGE | 0 – 20 |

| EST. NOMINAL RETURN | 2.5 – 4% |

| EST. VOLATILITY | 3 – 6% |

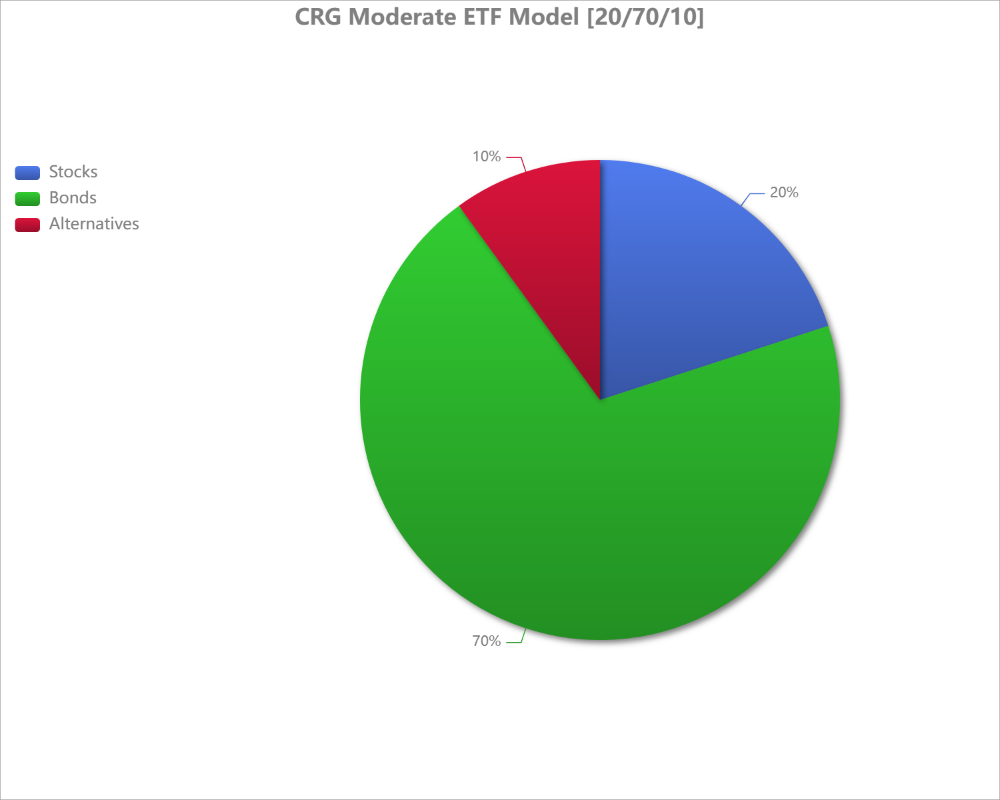

OBJECTIVE:

The Moderate ETF Model Portfolio is tailored for investors seeking a cautious approach to growth, balancing capital preservation with modest appreciation. This model is ideal for those who want to limit downside risk while still participating in equity market gains, blending stability with growth potential through a diversified mix of ETFs.

| RISK LEVEL | Moderate |

| TIME HORIZON (YRS) | 3 – 5 |

| RISK SCORE RANGE | 21 – 40 |

| EST. NOMINAL RETURN | 4 – 6% |

| EST. VOLATILITY | 6 – 9% |

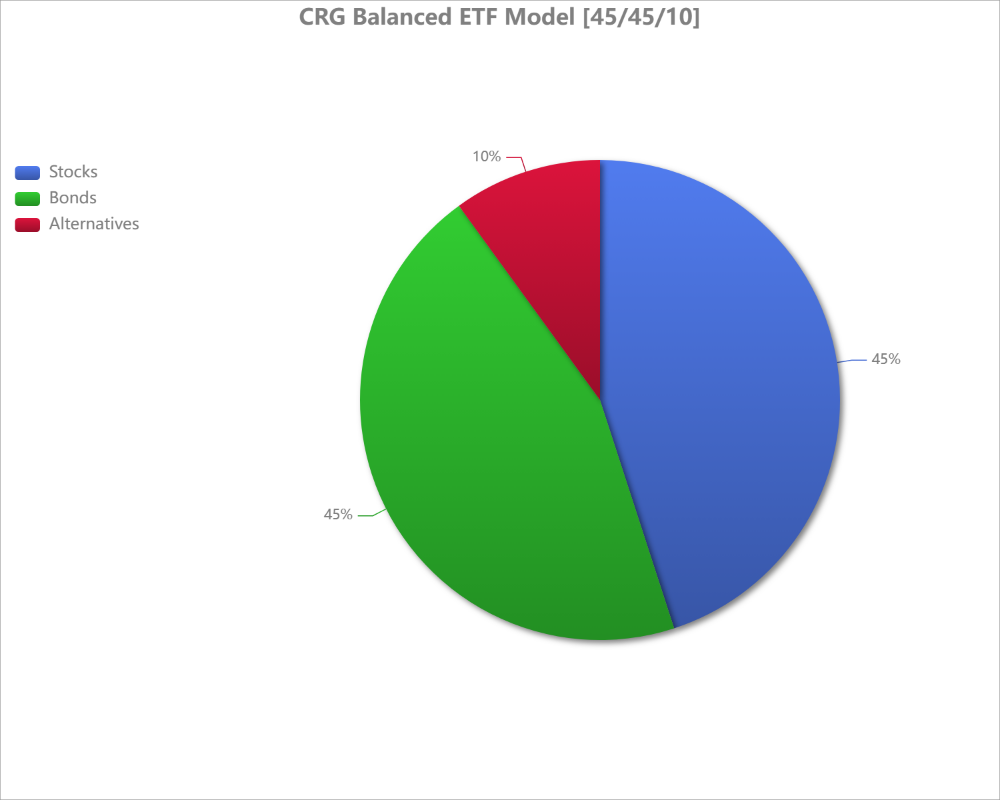

OBJECTIVE:

The Balanced ETF Model Portfolio is designed for investors seeking a harmonious blend of growth and income with a moderate level of risk. This portfolio aims to provide steady capital appreciation while managing volatility through diversified exposure to both equities and fixed income assets.

| RISK LEVEL | Balanced |

| TIME HORIZON (YRS) | 5 – 7 |

| RISK SCORE RANGE | 41 – 60 |

| EST. NOMINAL RETURN | 5 – 7% |

| EST. VOLATILITY | 8 – 12% |

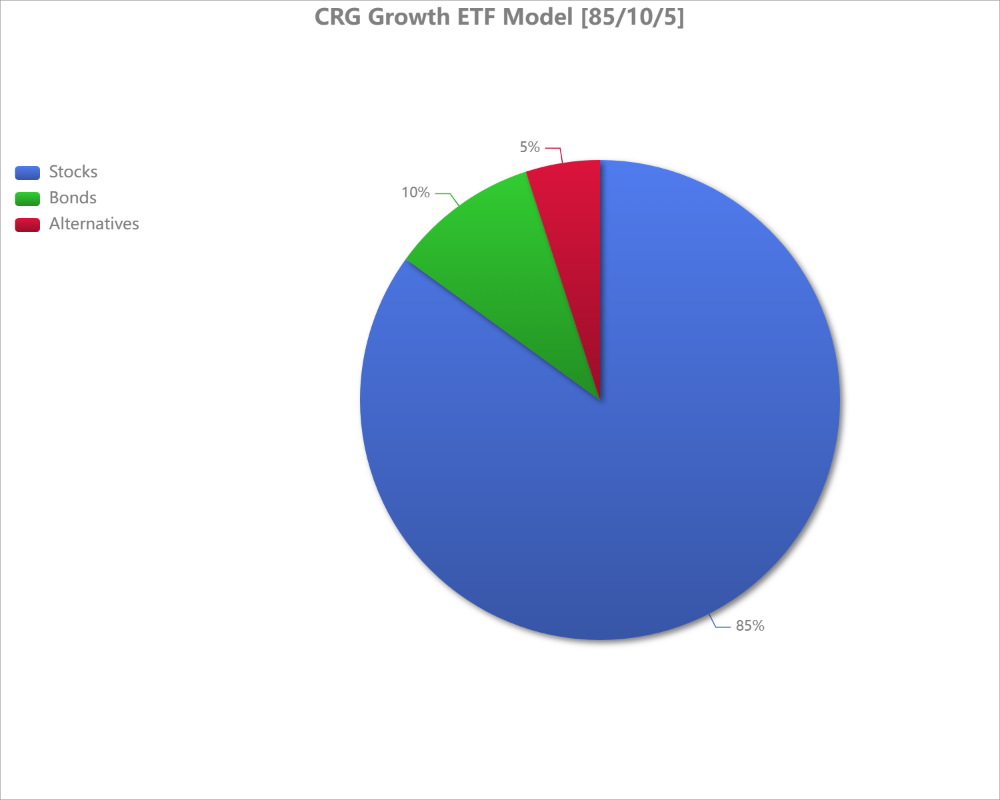

OBJECTIVE:

The Growth ETF Model Portfolio is designed for investors seeking a focus on capital appreciation with a balanced approach to risk. This portfolio aims to achieve above-average growth over the medium to long term by emphasizing equity exposure while maintaining diversification through fixed income investments to help manage volatility.

| RISK LEVEL | High |

| TIME HORIZON (YRS) | 7 – 10 |

| RISK SCORE RANGE | 61 – 80 |

| EST. NOMINAL RETURN | 7 – 10% |

| EST. VOLATILITY | 14 – 18% |

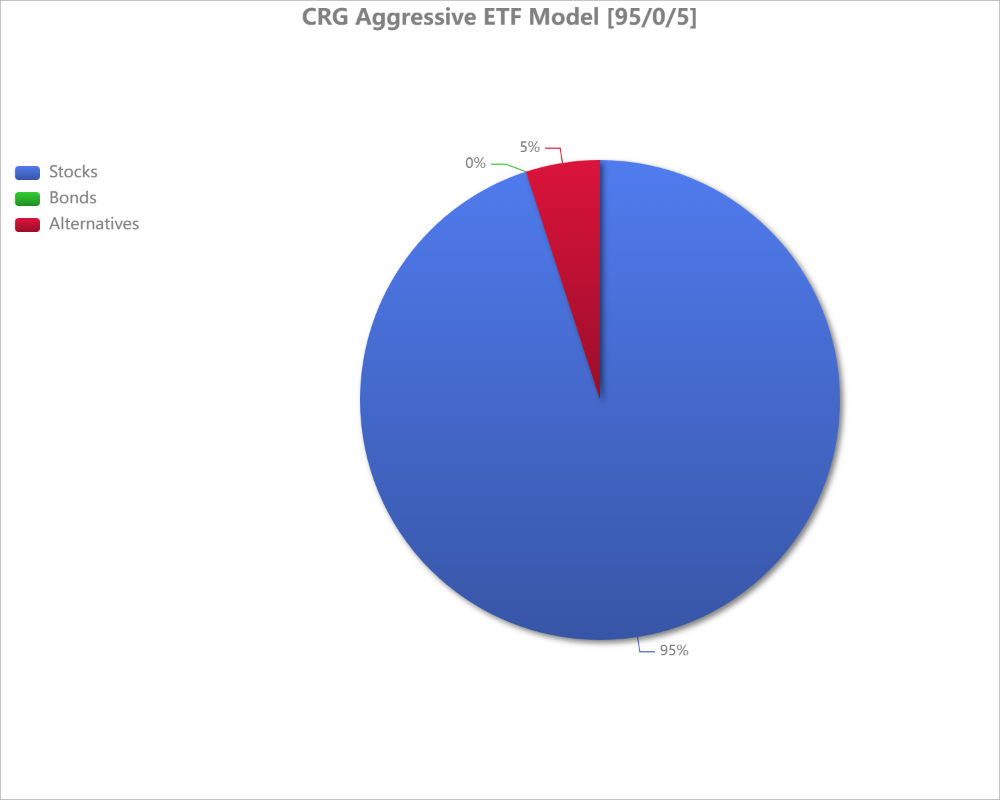

OBJECTIVE:

The Aggressive ETF Model Portfolio is designed for investors seeking maximum capital appreciation with a high tolerance for risk and market volatility. The model emphasizes growth-oriented equity investments, including exposure to emerging markets, small-cap stocks, and sector-specific ETFs, aiming to capture significant long-term gains.

| RISK LEVEL | Very High |

| TIME HORIZON (YRS) | 10+ |

| RISK SCORE RANGE | 81 – 100 |

| EST. NOMINAL RETURN | 9 – 12% |

| EST. VOLATILITY | 18 – 25% |

DUE DILIGENCE

Our team meticulously reviews hundreds of ETF funds from a short-list of reputable and experienced asset managers, including: Vanguard; Blackrock; JP Morgan; Invesco; and PIMCO.

Our process is methodical and structured to ensure suitability and optimal outcomes.

- First, we analyze the composition of each fund to understand it’s unique holdings.

- We prioritize diversification to mitigate risk and consider liquidity and holding costs to maximize long-term returns.

- By taking this detail-oriented approach, we construct robust and cost-effective risk-based ETF model portfolios that effectively match our clients’ financial goals & objectives, risk capacity & tolerance, and time horizon.

MONITORING & REBALANCING

We continually monitor and rebalance our ETF model portfolios to ensure that your investments align with your financial goals, risk tolerance, and market expectations. Rebalancing plays a crucial role in our investment management process, ensuring that our client portfolios stay within the intended allocation and risk profile over time.

Our quarterly ETF model rebalancing involves adjusting model holdings to maintain the desired asset allocation and investment strategy.

Having a carefully crafted plan for rebalancing, considering tax implications, and taking the overall portfolio into account helps to maintain well diversified model portfolios and avoid common mistakes associated with ETF rebalancing.

Key Steps Include:

- Establishing Clear Objectives

- Regular Performance Reviews

- Analyze Asset Allocation

- Monitor ETF Fund Characteristics

- Stay Informed on Market Conditions

- Consider Tax Implications

By following these steps, we effectively monitor your ETF model portfolio and make informed decisions to achieve your investment objectives, while adhering to your risk tolerance.

A FOCUS ON YOUR LIFE GOALS

With goals-based investing, the focus shifts from abstract objectives such as maximizing portfolio returns to more specific life goals that truly matter to you – we start with the “why” behind your investments to:

- Align your investments with your life goals

- Measure progress towards specific milestones

- Receive personalized guidance from our wealth experts

- Enjoy the peace of mind that comes with a clear plan

BRINGING THE FUTURE INTO THE PRESENT

From retirement planning, investment strategies, tax optimization, to estate planning, we offer personalized solutions tailored to your unique circumstances.

Address

2325 E. Camelback Rd., Ste 400, Phoenix AZ 85016

Phone

(480) 364-7401

We specialize in personalized retirement solutions for small & mid-sized businesses, the self-employed, and individual investors in healthcare.

LEGAL DISCLOSURE

Cognis Group is a State registered investment adviser, pursuant to the Investment Advisers Act of 1940, as amended, with principal offices in Phoenix AZ. Cognis Group and its representatives are in compliance with the current filing requirements placed upon registered investment advisers by those states in which it maintains clients. A copy of our current written disclosure statement (Form ADV-Part 2) discussing business operations, services and fees is available upon request or may be downloaded here.

This website does not constitute an offer to provide investment advisory services in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. The information contained on this site is for informational purposes only and should not be construed as financial, investment, legal, tax, or other advice. By accessing this website, you agree to be bound by the above terms and conditions.

Check the background of investment professionals associated with this site on the Investment Advisor Public Disclosure website.